Shorting NFTs

As investors increase their NFT holdings and gain exposure to the NFT market, they are also becoming increasingly interested in limiting their risk - or even betting against the market.

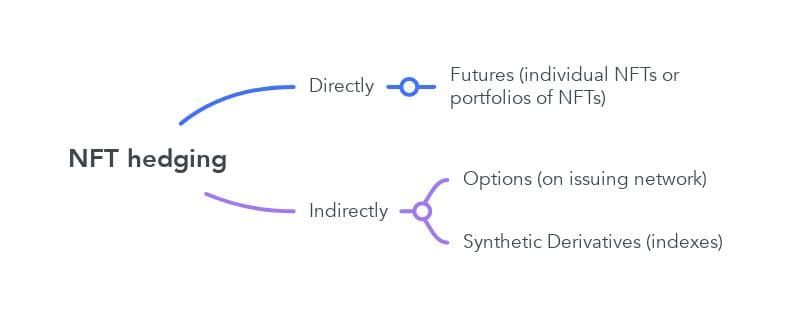

There are several ways to implement hedging strategies in the NFTs market.

Direct: Typically involves using futures to short or long individual NFT assets (with leverage).

Indirect: Betting for or against an index that follows the NFT market, or, Trading options (e.g., put option) on networks where NFT are issued (such as Ethereum)

Projects that facilitate NFT hedging include:

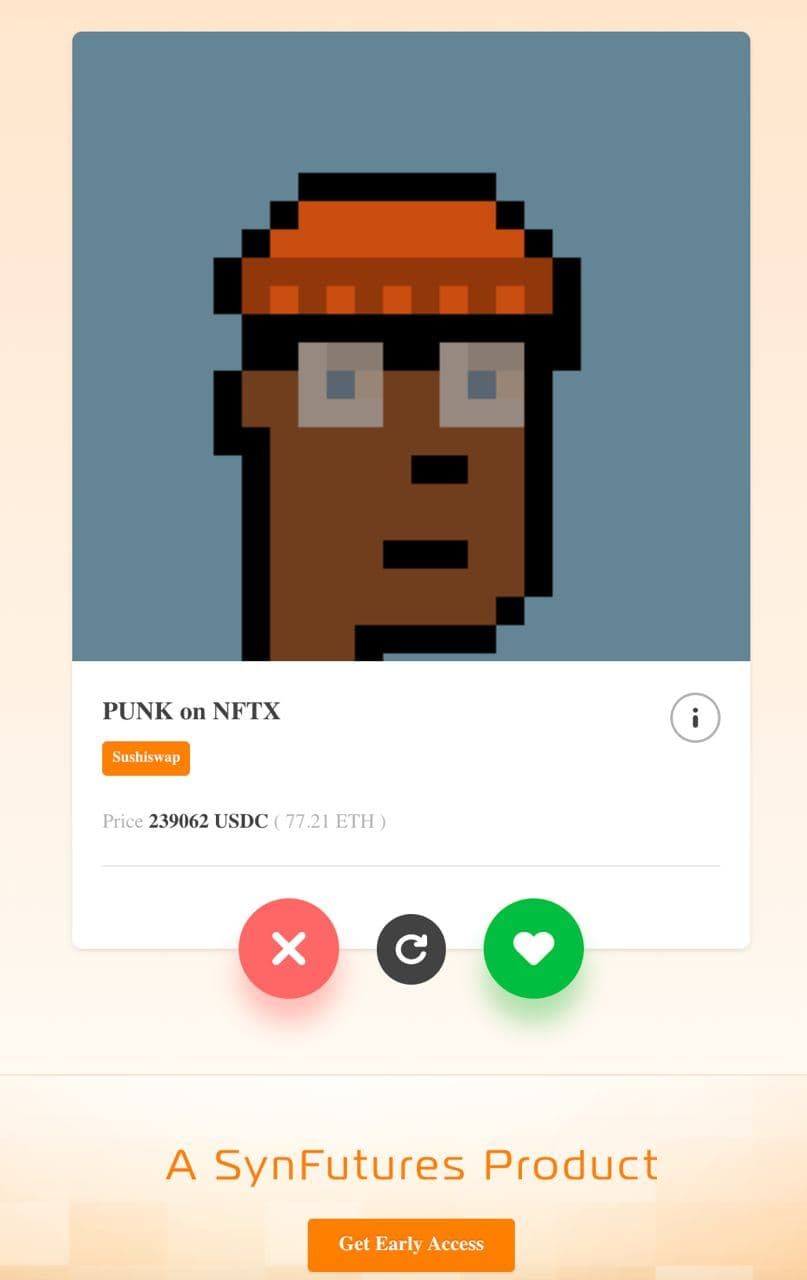

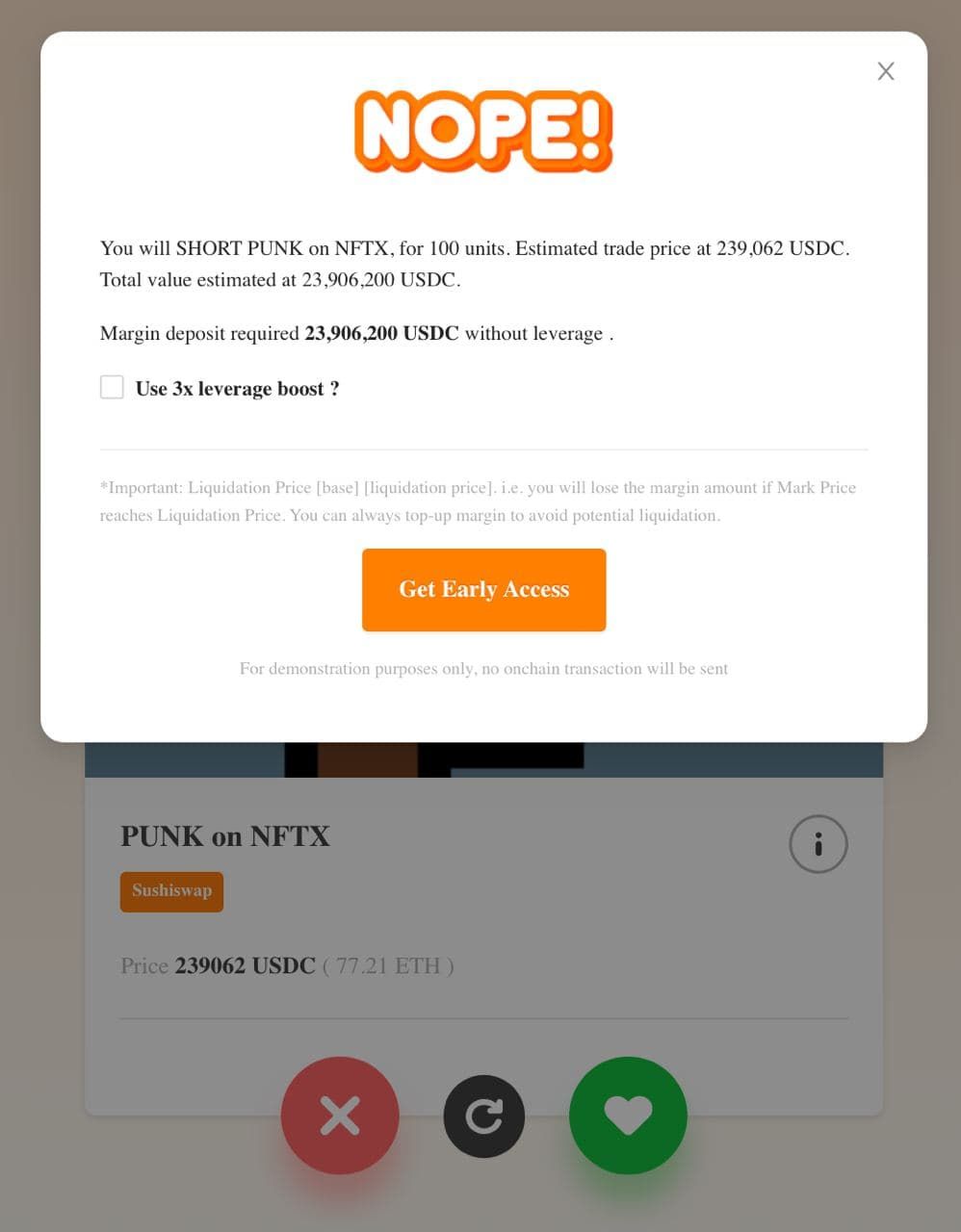

Nftures is a product currently in beta. The creator is SynFutures, a company that was launched a year ago and has increased its web traffic by 85% in that period.

The interface is very user-friendly, essentially a Tinder-like experience — an innovation in shorting financial products.

Clicking the red button will short the NFT. Using 3x leverage (borrowing) will reduce the deposit requirement to 1/3 of the margin (in this case, the deposit goes from 23906200 USDC to 7968733 USDC). The prices are denominated in USDC, a stable coin popular in the NFT industry (supported in networks such as Ethereum and Solana).

Deribit Trade Application

Deribit is one of the more liquid crypto derivative exchanges, however, the tools are designed for more sophisticated strategies in mind (so, could be less intuitive). They offer ETH options.

Catalyst | A Synthetic NFT Derivative Platform

Catalyst published a development roadmap for NFT derivatives 6 months ago, but there has been no news published lately.

Disclosure: Edgeseekers does not endorse particular projects or strategies, the information presented is for educational purposes only.