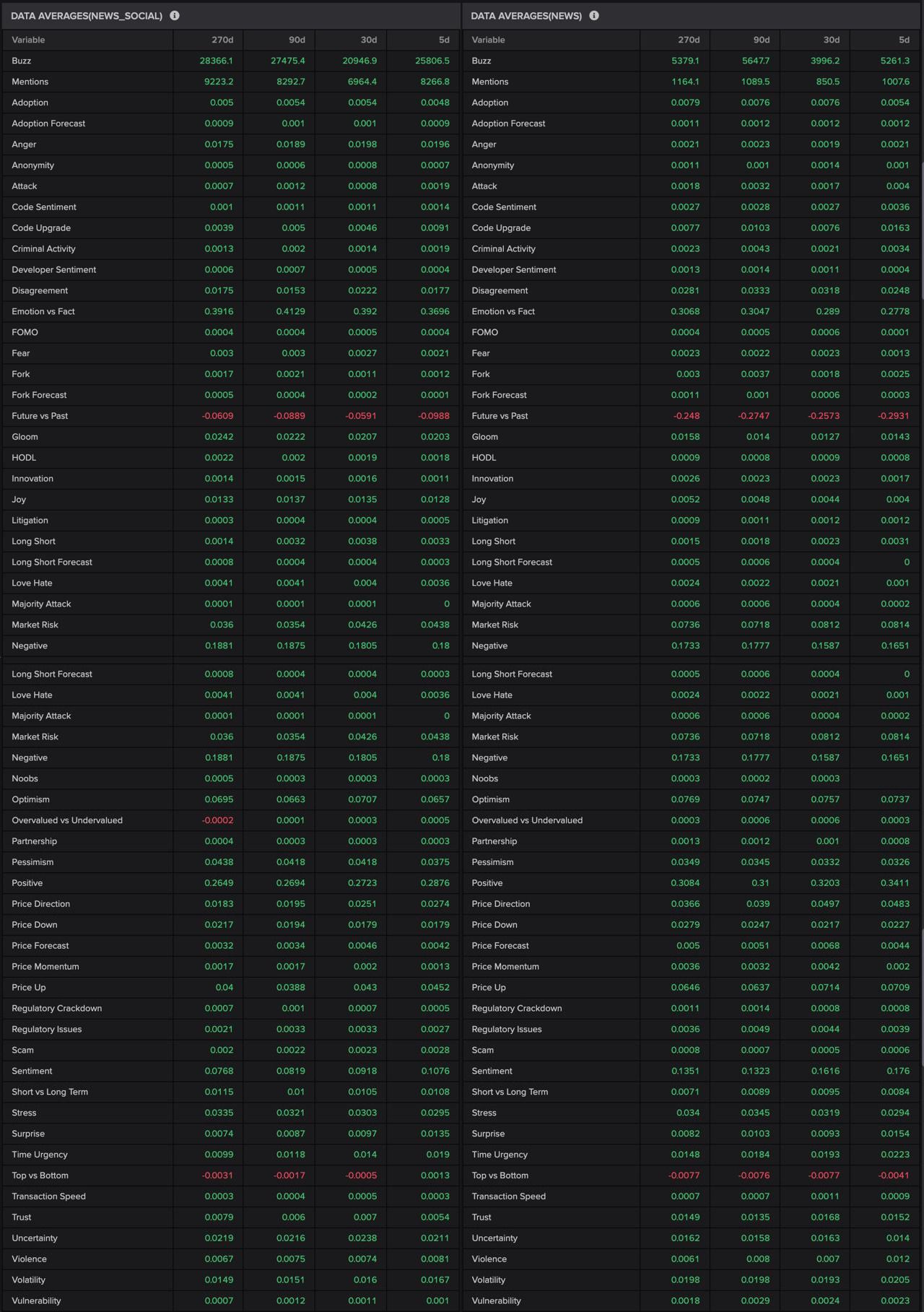

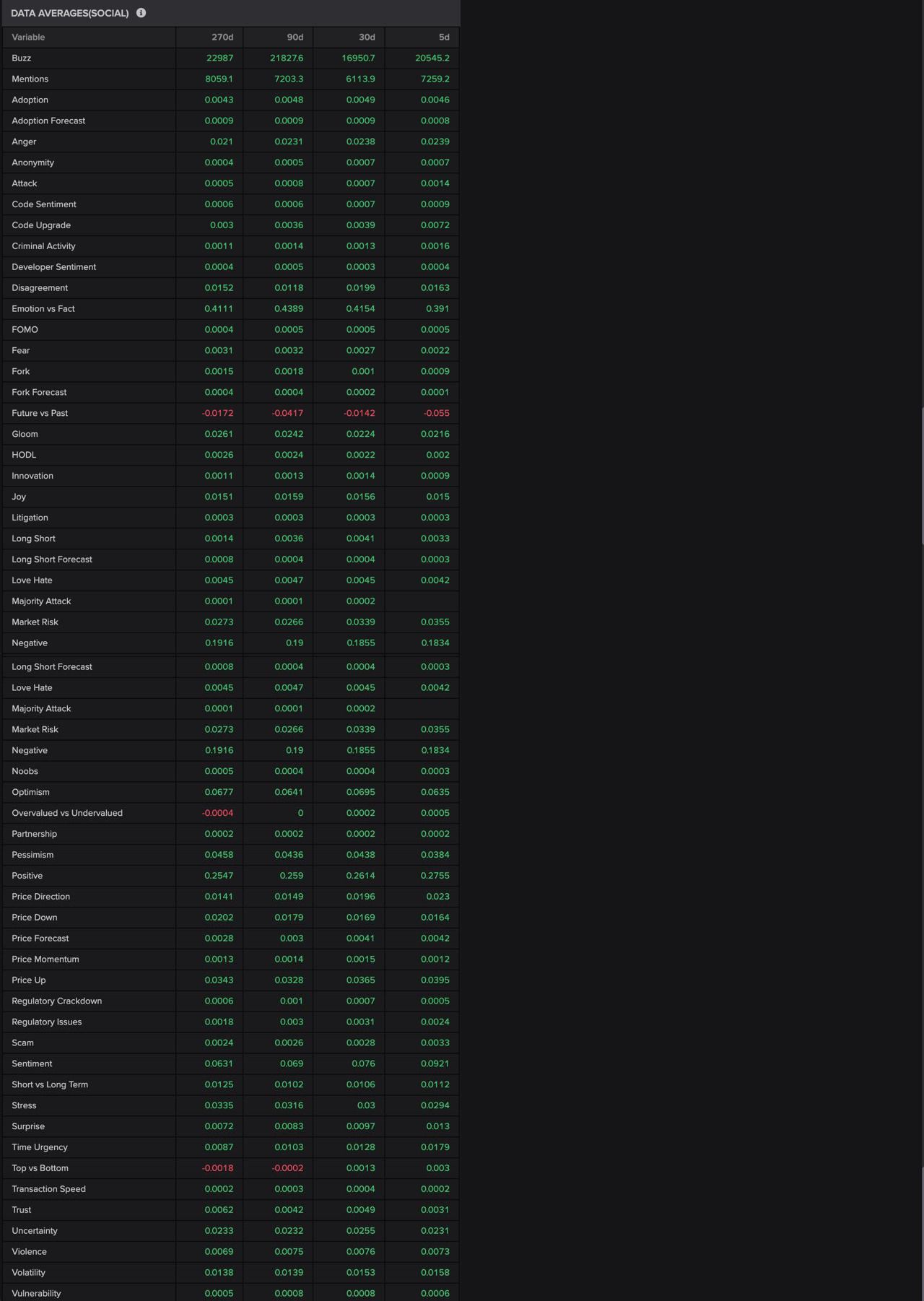

However, the other key components to anticipate demand and possible network issues are actually externalities: the market sentiment about the crypto that is used to issue the tokens, and the emotions expressed by market participants. Here we will demonstrate our approach to timing the market using text analytics and sentiment.

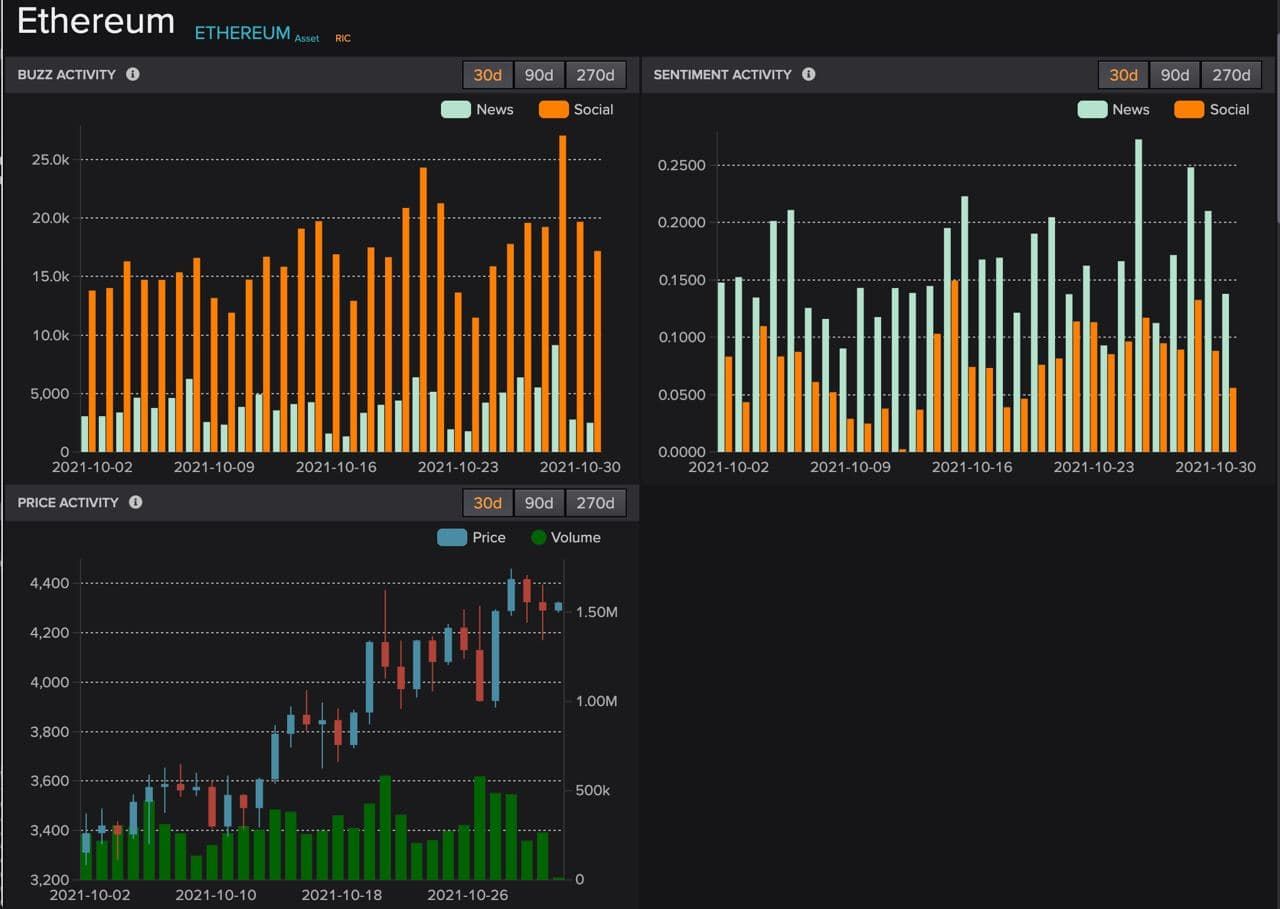

First, we look at the overall network perception: is there a buildup in the sentiment and volume of references (buzz)? Is this coming from mainstream media outlets or just social channels? What are the actual sources (to the YouTube profile and subReddit level)? These indicators inform us about possible upward pressures in general public interest that can in turn create conditions for network congestion.

Here is the full list of emotions tracked:

Metrics definitions: